In the UK, the Consumer Price Index (CPI) for February, which we follow today, exceeded the expectations and increased by 1.1% monthly and 10.4% annually. Core CPI also beat expectations, rising 1.2% and 6.2%, respectively. In the previous data, annual CPI was 10.1% and Core CPI was 5.7%. After the data, the GBPUSD parity rose with the expectations that the Bank of England (BOE) will continue to raise interest rates to reduce inflation.

In his speech today, President of the European Central Bank (ECB) Lagarde said that inflation is high, uncertainty about the future is increasing, they need to reduce inflation and bring it to the target, they have promised neither to raise interest rates any more nor to end them, and there are no signs of a downward trend in core inflation.

Tonight at 21:00 (GMT+3), the FED will announce its interest rate decision. The Fed is expected to raise the interest rate from 4.75% by 25 basis points to 5.00%. After the decision, Fed Chairman Powell is expected to make statements about the decision and the situation of bankrupt banks.

According to the decision taken after the FED, the volatility may increase. It will be a day to be careful.

With the Credit Suisse news, the US 10-year bond yield dropped to 3.29%. But interest rates reacted after Monday ended with a positive doji and the US was at 3.61% on the 10-year mark.

EURUSD parity is priced at 1.0785 Ounce Gold 1944 and USDJPY parity is priced at 132.68.

Agenda of the day;

- 21:00 (GMT+3) FED Interest Rate Decision

- 21:30 (GMT+3) Speech by FED Chairman Powell

Open A Demo

CDO has wide range of tools, professional and friendly support for clients to achieve their financial markets trading goals. Open a live account now to enjoy this experience with virtual deposit.

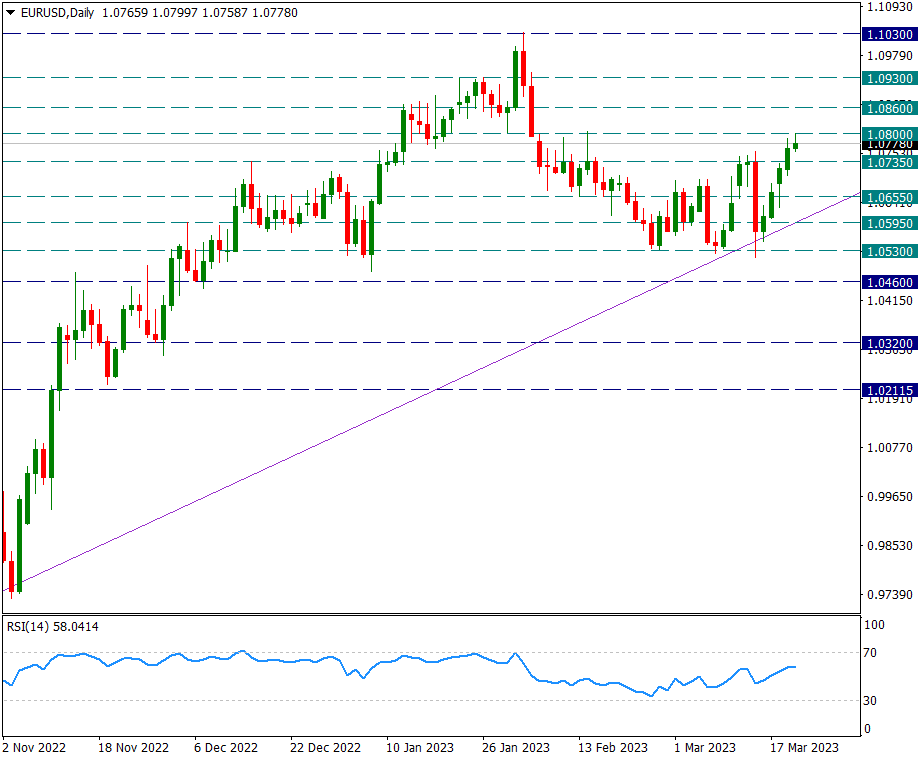

EUR/USD

EUR/USD – FED Decisions Could Open the Way for Volatility Storm…

While the decisive statements of the European Central Bank in the fight against inflation brought the Euro side to remain strong, the rescue efforts of Credit Suisse for now support the Euro. However, we will continue to monitor the news feeds.

The pair closed yesterday above the 1.0735 resistance and very close to 1.08. 1.08 continues to be tested today. Closes above 1.08 may make the movement in favor of the Euro stronger in the pair. However, we continue to watch the uptrend line from 0.9550 as the main support for possible movements in favor of the dollar.

The FED decision tonight at 21.00 (GMT+3) will definitely increase the volatility in the parity, so the levels we have stated during the day are important, but after 21.00 (GMT+3), the FED decisions will be more critical.

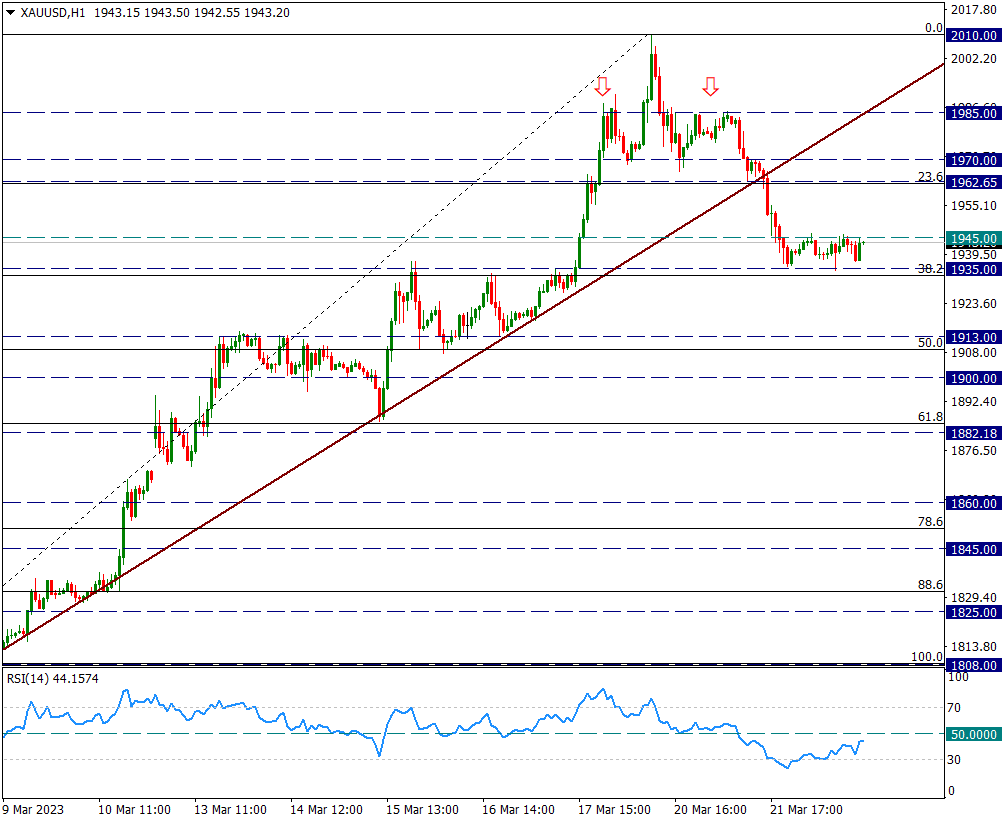

XAU/USD

XAU/USD – Post-FED 1935/1945 Squeeze Could Be Broken…

After running the shoulder head and shoulders formation, which is more clearly visible on the yellow metal hourly chart, it regressed to the 1935 support. With this regression, he made the Fibonacci 38.2 correction of the 1808/2010 rise, which took place in a short time.

During the day, it was priced at around $10 margin above the 1935 support. Therefore, there is some positive dissonance in the RSI on the hourly chart, but as long as the RSI does not rise above the 50 level on the hourly chart, this current dissonance may come to naught. At this point, 1945 will be the first intermediate resistance level. But we would like to point out that the main resistance was 1962.

If the correction of the 1808/2010 rise continues, 1913 and 1882 levels may come to the fore in the breakdown of 1935.

CDO TRADER

CDO TRADER, our cutting-edge trading platform, follows the technology from the forefront with new features added continuously. Moreover, CDO TRADER is now available for Android and iOS! So it allows you to trade on the go!

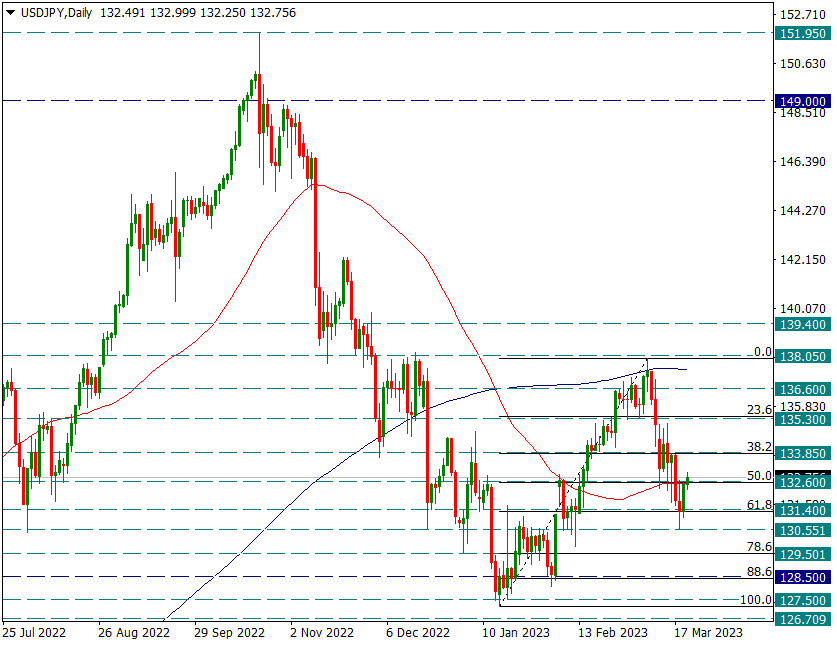

USD/JPY

USD/JPY – Pricing Continues in the 50-Day Average Region…

Along with the bankruptcy news, the Japanese Yen was reactivated as a safe haven and the USDJPY parity moved in favor of the Yen, falling from 138.05 to 130.55. This retracement ended after the 126.70/138.05 rise in the 2023 January – early March period corrected the Fibonacci 61.8. During the day, 131.40 will be followed as the main support and 135.30 as the main resistance.

MetaTrader 4

MT4 has user friendly interface that is providing simplicity and efficiency. The traders can perform trading strategies for different products like Forex and CFD. MetaTrader 4 has over 50 built-in indicators, also it’s the tool that predicts trends and defines the appropriate entry and exit points.

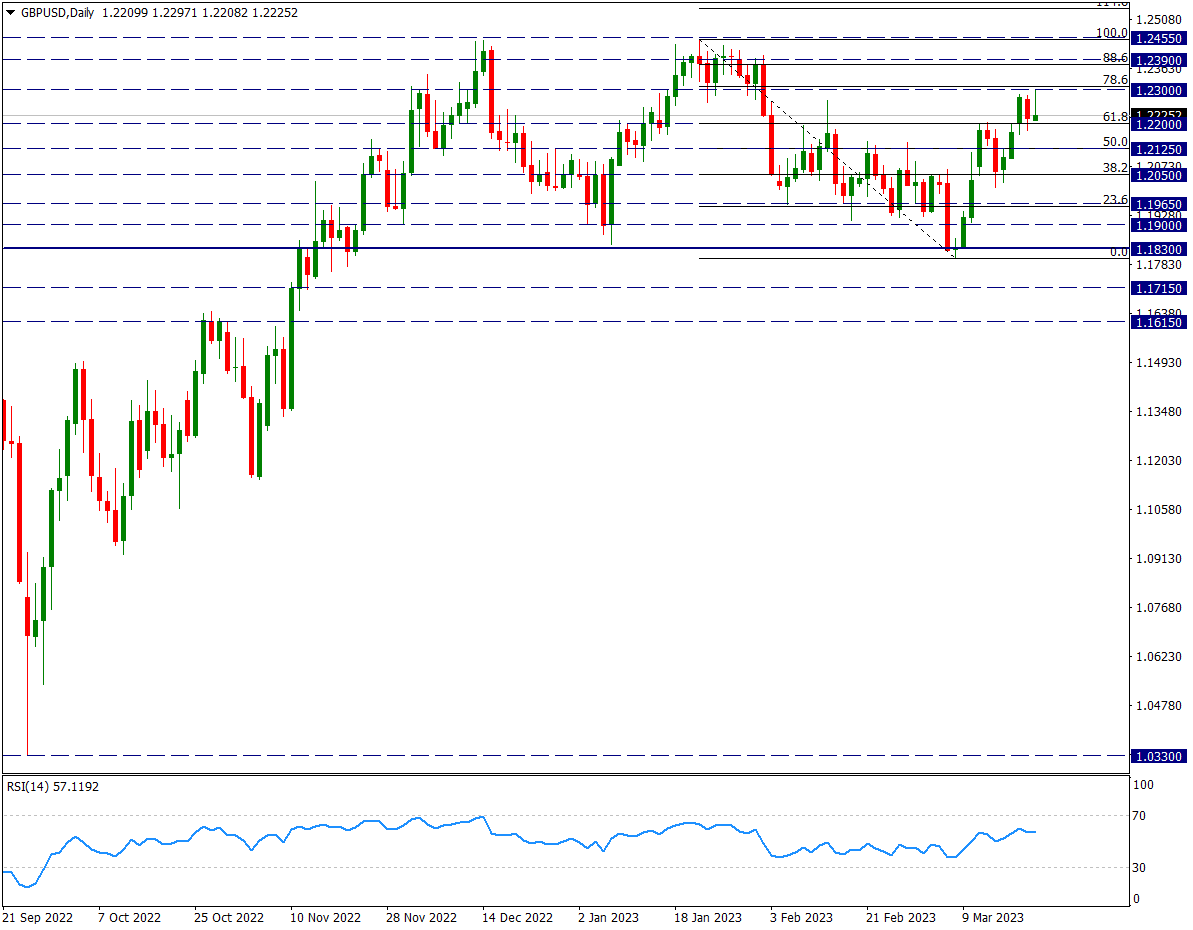

GBP/USD

GBP/USD – The Recent Rising is Protected by 1.22 Support…

The pair is stuck in the Fibonacci 78.6 and 61.8 range of the 1.2455/1.1830 drop. As of the FED, this three-day squeeze may be broken due to the dollar leg. However, for now, holding above 1.22 in general seems to be positive for movements in favor of Sterling. This image might get stronger over 1.23. We will follow this.

On the weekly side, the main resistance is the 1.2455 high on January 23 and the main support is the 1.1830 support on March 8.

Contact Us

Please, fill the form to get an assistance.