*International financial markets started the new week relatively calm, compensating for last week’s hedging sales. However, there are still critical data and figures that we follow on the agenda.

The US 10-year Treasury yield continues to rise to 4.33%, at its highest level in recent times. Here the pressure is still high and exceeding 4.33% could quickly indicate 4.5% levels.

While the US Dollar index rose for five consecutive weeks, it was stuck at 103.60 in the new week. But the fixes are weak.

US stock indexes are trying to make up for last week’s losses with a slight reaction.

*PMI data of Germany and the USA will be monitored on Wednesday during the week, and the speech of FED Chairman Powell at the Jackson Hole symposium at 17.05 at the end of the week will be very important.

*Japanese Yen side fell from 146.50 to 145.00 as it approached the end of last week. While we receive a mild reaction from this important 145.00 support as of the new week, we can follow the possible verbal guidance of the Bank of Japan in the coming days.

*Citigroup lowered China’s 2023 growth forecast from 5% to 4.7%. UBS lowered its growth forecast for China in 2023 from 5.2% to 4.8%. It had previously announced a forecast of 5.7% in June.

Open A Demo

CDO has wide range of tools, professional and friendly support for clients to achieve their financial markets trading goals. Open a live account now to enjoy this experience with virtual deposit.

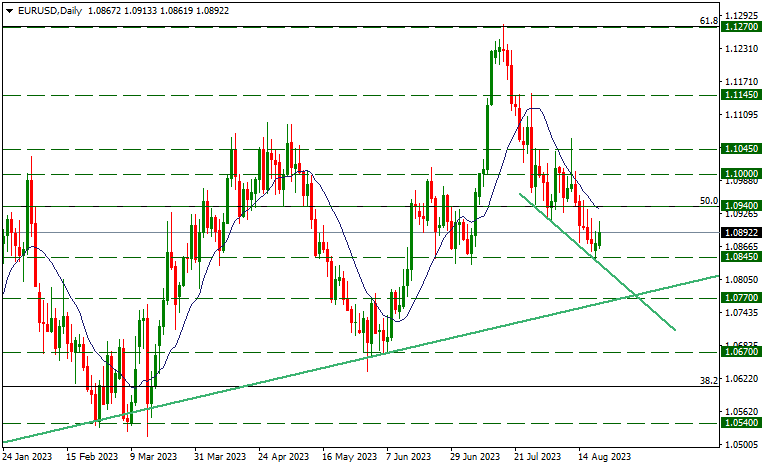

EURUSD

EURUSD – Rebounds Continue To 1.0913…

The pullbacks in the pair last week continued until the level of 1.0845. With the support received at this level, upward pricing attempts continued today. Although the rises continue to the level of 1.0913, instant pricing is moving around 1.0892. On the downside, 1.0845 may continue to form support. In upward pricing, the 1.0940 level can be followed as resistance.

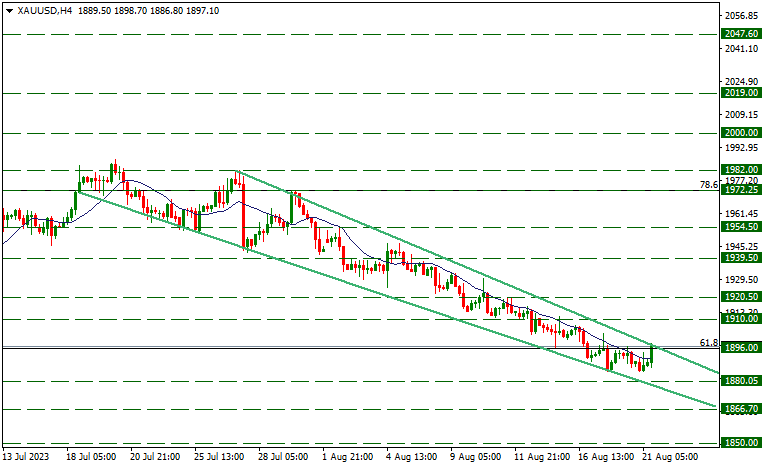

XAUUSD

Ounce Gold – Reached 1896 Resistance…

While the bearish trend continues in the yellow metal, there were recovery towards the upper band of the downside channel today. At the same time, this level is followed as resistance, which corresponds to the Fibonacci 61.8 step found at the 1896 level. The support level that we will follow in the pullbacks that can be taken from this resistance will be 1880.05. Technically, we expect downward pricing to continue as long as the channel is not permanently surpassed.

CDO TRADER

CDO TRADER, our cutting-edge trading platform, follows the technology from the forefront with new features added continuously. Moreover, CDO TRADER is now available for Android and iOS! So it allows you to trade on the go!

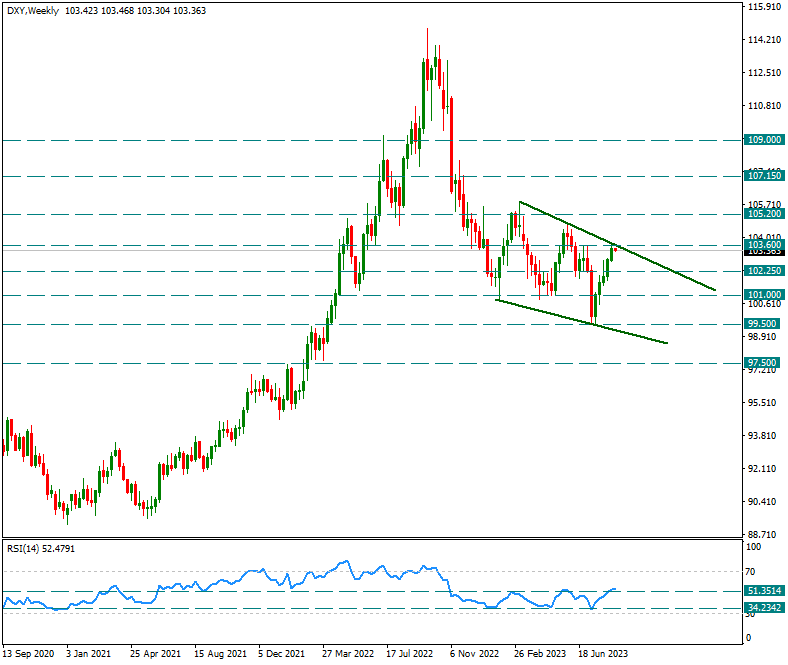

DOLLAR INDEX

Dollar Index – 103.60 Level Is An Important Region As Resistance…

The dollar index reacted after touching the 99.50 level and went up to 103.60 after five weeks of non-stop rising. We see that it stalled at 103.60 in the new week. Technically speaking, we encounter a minor downtrend resistance on the weekly chart, and this downtrend resistance is blocking the rise in the dollar index for now. In general, unless we see a daily or weekly close above the 103.60 level, it may be necessary not to be in a hurry to continue the rises.

However, if this resistance is broken, we can see a step-by-step attack towards 105.2 and 107.15.

FED Chairman Powell’s Jackson Hole speech on Friday this week will be important for the dollar index.

MetaTrader 4

MT4 has user friendly interface that is providing simplicity and efficiency. The traders can perform trading strategies for different products like Forex and CFD. MetaTrader 4 has over 50 built-in indicators, also it’s the tool that predicts trends and defines the appropriate entry and exit points.

Contact Us

Please, fill the form to get an assistance.