*In his speech today, European Central Bank (ECB) member Kazimir said that a possible rate hike is still needed, that a 25 basis point increase in interest rates may be preferred next week, alternatively in October or December, and inflation is stubbornly high.

*Boston Fed Chairman Collins said in a statement that they welcome signs of slowing inflation, but there are still signs of pressure, it is premature to say that inflation is back to target, labor market demand is still too high and wage growth remains above the 2% inflation target.

*Service PMI indices from the USA were announced during the day. The first data disclosed was S&P Global’s Service PMI data, which arrived at 16.45. Although this data came above the positive zone of 50, it declined and became 50.5.

The ISM Service PMI, which was announced 15 minutes later at 17:00, was 54.5, which was higher than expected and compared to the previous month. After the data, the US Dollar index strengthened and the US 10-year bond yield again approached 4.30%.

A move above 4.30% in the US 10-year Treasury yield could further strengthen the dollar index and put the yellow metal under pressure.

Open A Demo

CDO has wide range of tools, professional and friendly support for clients to achieve their financial markets trading goals. Open a live account now to enjoy this experience with virtual deposit.

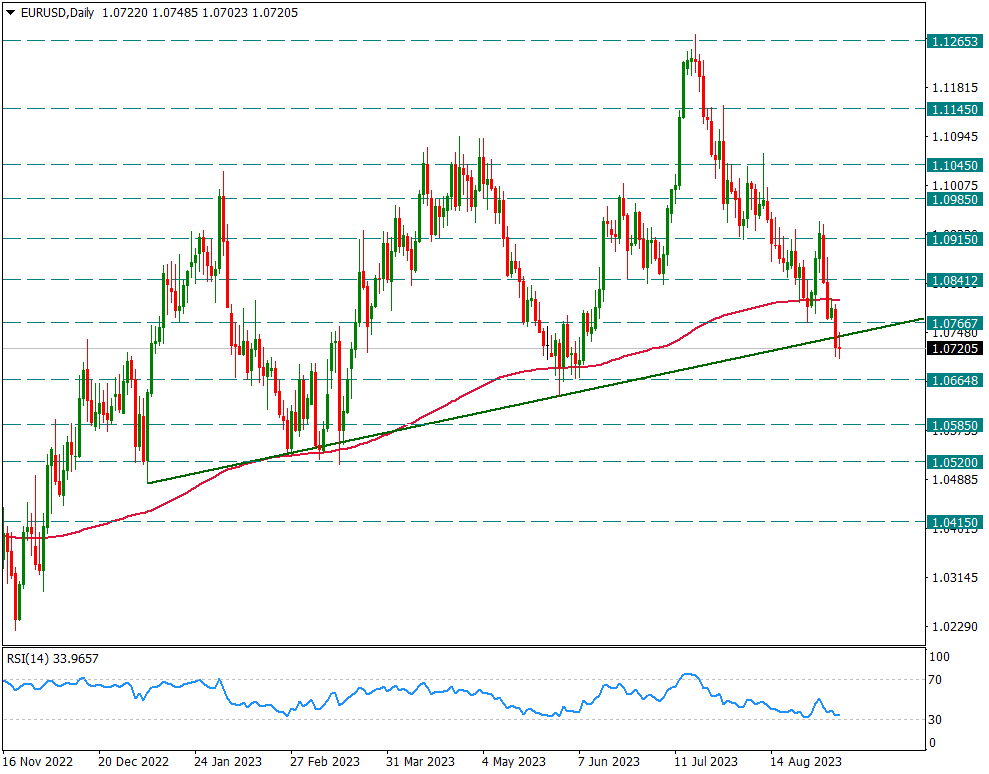

EURUSD

EURUSD – Dollar Pressure Started to Increase with ISM Service Data…

The pair started to close candles below the 200-day average last week and after this situation, the attacks remained very weak. After the ISM Service PMI data, which came today, the movements in favor of the dollar strengthened and the parity decreased to the level of 1.0702.

In general, it will be technically difficult to expect the reactions to be permanent unless the 1.0766 level is exceeded in the short-term view.

If possible decreases continue, a step-by-step regression towards 1.0520 can be envisaged.

XAUUSD

Ounce Gold – ISM Reactions After Service PMI Returns…

After the fall yesterday, the decline continued until 1920, but there was a reaction afterwards. However, the strong US ISM Services PMI at 17:00 caused the intraday reaction in the yellow metal to reverse. Yellow metal declined again from 1927 to 1920. In general, as long as intraday movements remain below 1937 in the short term, negative movements may dominate.

CDO TRADER

CDO TRADER, our cutting-edge trading platform, follows the technology from the forefront with new features added continuously. Moreover, CDO TRADER is now available for Android and iOS! So it allows you to trade on the go!

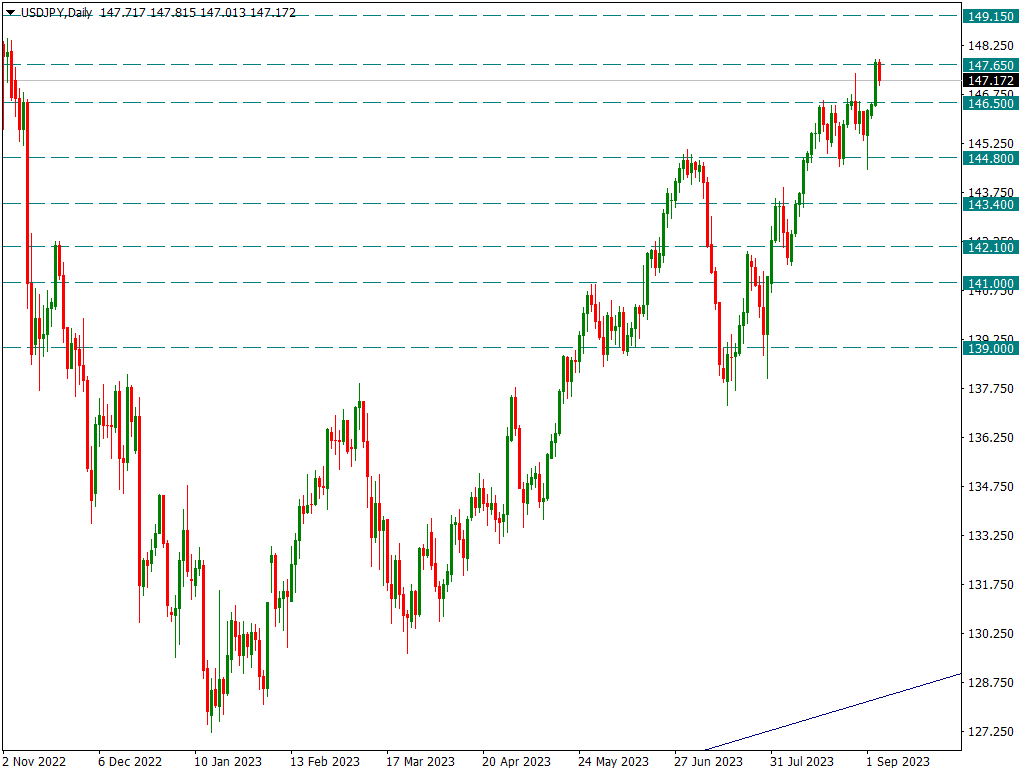

USDJPY

USDJPY – 146.50 Main Intraday Support…

After the hard attack yesterday, the pair rose to the resistance of 147.65 and closed the daily candle close at this level. Although there is some profit selling today, as long as it stays above the 146.50 level, it can be predicted that the attacks will extend towards the 150 region in the short term. If it is below 146.50, a recovery process in favor of Yen may be triggered.

MetaTrader 4

MT4 has user friendly interface that is providing simplicity and efficiency. The traders can perform trading strategies for different products like Forex and CFD. MetaTrader 4 has over 50 built-in indicators, also it’s the tool that predicts trends and defines the appropriate entry and exit points.

Contact Us

Please, fill the form to get an assistance.