The interest rate decision will be announced at 21:00 at the FED meeting to be held tonight. Expectations are for an increase of 25 basis points. After the decision to be taken, we will follow the statements of FED Chairman Powell. As US regional banks come under pressure once again before the upcoming rate decision, once again there will be a situation where markets will look at the Fed decision and see if Powell can offer any relief after yesterday’s tensions.

The pre-FED EURUSD parity is above 1.10 and the Ounce Gold is priced above $2000 by protecting the attacks it made yesterday. The US 10-year bond yield is at 3.40%. The unemployment rate in the Euro Area in March decreased by 0.1 compared to the previous month and fell to 6.5%.

*In the US, ADP non-farm employment change for April, which was announced before the Official Non-Farm Employment data to be announced on Friday, increased by 296,000, against the expectation of an increase of 148,000. There was an increase of 142,000 in the data announced last month. S&P Global April services PMI data, announced at 16.45 in the USA, was announced as 53.6, just below the 53.7 expectation. The data, which was announced at the level of 52.6 last month, improved by 1 point. Thus, the positive outlook in employment continued in the service PMI.

The ISM Services PMI index, which was also announced at 17.00 from the USA, was again in the positive region and realized as 51.9. The previous data was announced as 51.2. The manufacturing sector has slowed significantly, but the positive trend continues in the services sector, which makes up the majority of the economy.

Open A Demo

CDO has wide range of tools, professional and friendly support for clients to achieve their financial markets trading goals. Open a live account now to enjoy this experience with virtual deposit.

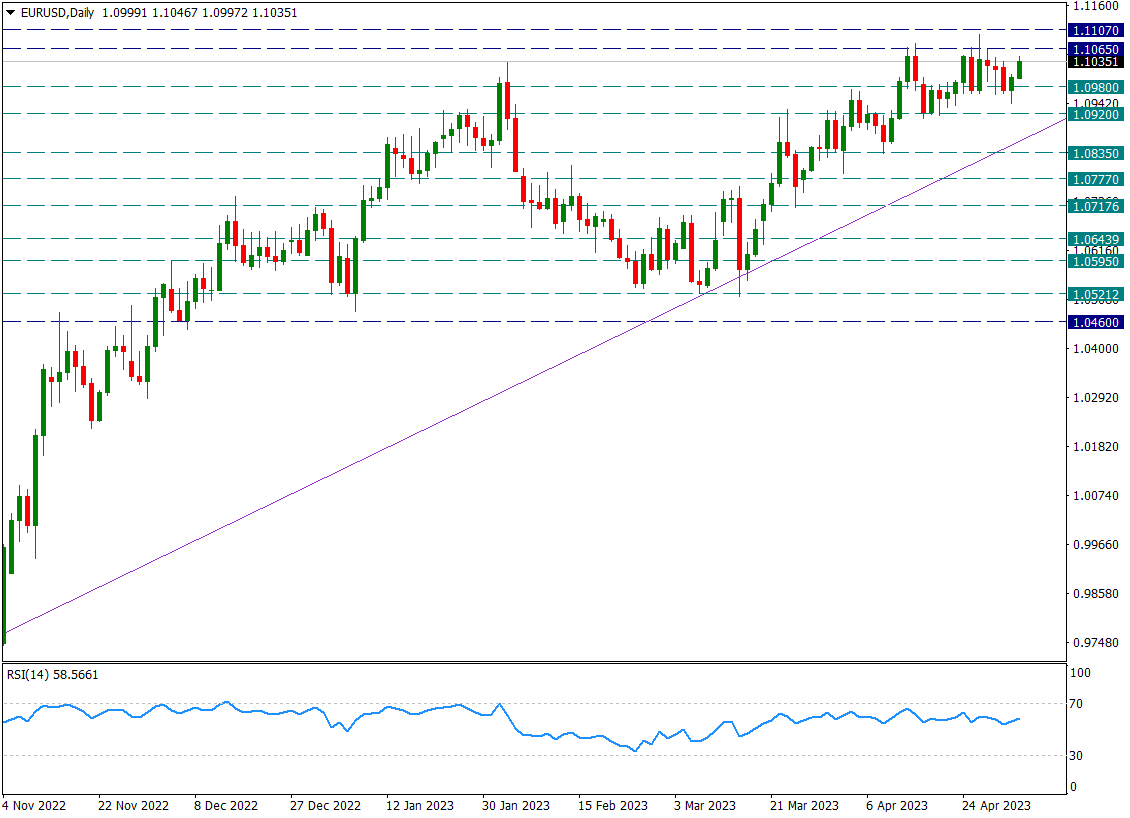

EURUSD

EURUSD – Maintains Current Levels Until FED Hours…

The pair continues to stay above the 1.0920 support, reacting again from each pullback. However, this time, the 1.1065 level is blocking the prices as resistance. This squeeze before the FED is quite normal.

Looking at the technical levels, 1.0920 will be followed as the main daily support and 1.1065 as the main daily resistance. Possible dove messages from the FED (for example, a communication that the interest rate hike is over) may cause an upside reaction in the pair. However, if the emphasis is on inflation and there is a thought that interest rate hikes may not end, the uptrend line from 1.0920 and 0.9550 will be followed during the day.

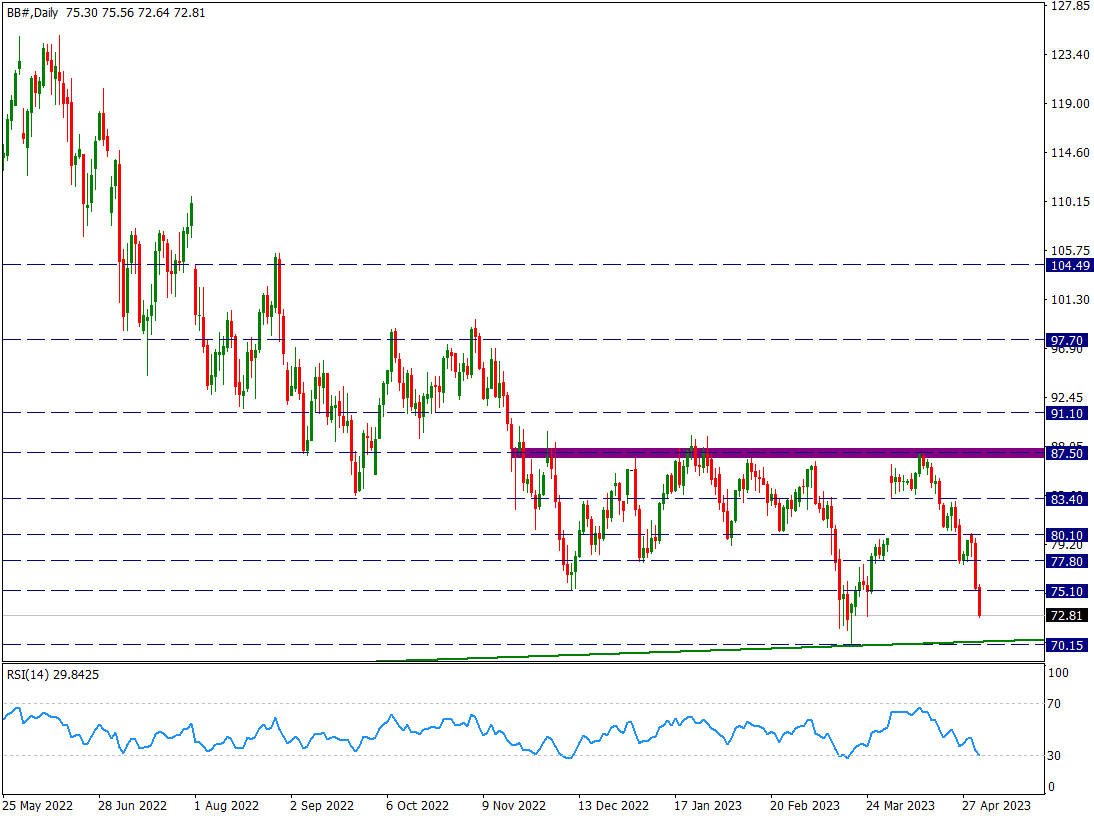

BRENT

Brent – Breaks 75.10 Support, Next Support 70.30

It has been pulling back sharply since the beginning of the week from 80.10 level. As of today, it also broke the 75.10 support and regressed to 72.65. Our next resistance is our 75.10 level and if it fails to rise above it, the negative pressure may increase. The next support zone is 70.15, the lowest level seen this year.

Therefore, we will now watch the movements in the range of 75.10 to 70.15. A break of 70.15 could feed a very strong selling wave.

CDO TRADER

CDO TRADER, our cutting-edge trading platform, follows the technology from the forefront with new features added continuously. Moreover, CDO TRADER is now available for Android and iOS! So it allows you to trade on the go!

XAUUSD

Ounce Gold – Slightly Corrected the Reaction Before FED Yesterday…

Yesterday, after the banking crisis concerns became clear again, the yellow metal rose rapidly due to the safe haven and broke the narrowing triangle in which it was stuck. The yellow metal reacted with this attack until the 2020 resistance. As of today, some of this rise has been undone and there has been mild backlash from 2005 support back to 2013.

The main intraday support is the 2005 level. As long as it stays above this level, the profit selling of yesterday’s strong buying wave may look normal.

FED decisions can increase volatility in the yellow metal, so it would be correct to evaluate price movements based on technical levels before 21:00. After 21:00, the decisions of the FED may have an impact on the yellow metal.

MetaTrader 4

MT4 has user friendly interface that is providing simplicity and efficiency. The traders can perform trading strategies for different products like Forex and CFD. MetaTrader 4 has over 50 built-in indicators, also it’s the tool that predicts trends and defines the appropriate entry and exit points.

Contact Us

Please, fill the form to get an assistance.