*Manufacturing and Services PMI data announced in Europe today showed a contraction. Manufacturing PMI fell from 40.6 to 38.8 in Germany, from 43.4 to 42.7 in the Eurozone and from 46.5 to 45.0 in the UK. The Services PMI, on the other hand, fell from 54.1 to 52.0, from 52.0 to 51.1, and from 53.7 to 51.5, respectively. After the data, there were decreases in EURUSD and GBPUSD parities.

* In the assessment made by China, it was stated that the Chinese economy is facing new challenges and challenges, macro adjustments will be implemented decisively and strongly, and domestic demand is not sufficient.

*Manufacturing PMI for July, which we tracked in the USA, came in at 49.0, exceeding the expectations of 46.4. Services PMI, on the other hand, fell short of the expectation of 54.0 and came in at 52.4. In June, Manufacturing PMI was 46.3 and Services PMI was 54.4. PMI data below 50 indicates a shrinkage in the sector. Data over 50 indicates growth in the sector.

Agenda of the day;

18:30 US Treasury Bill Auction

20:00 US Bond Auction

Open A Demo

CDO has wide range of tools, professional and friendly support for clients to achieve their financial markets trading goals. Open a live account now to enjoy this experience with virtual deposit.

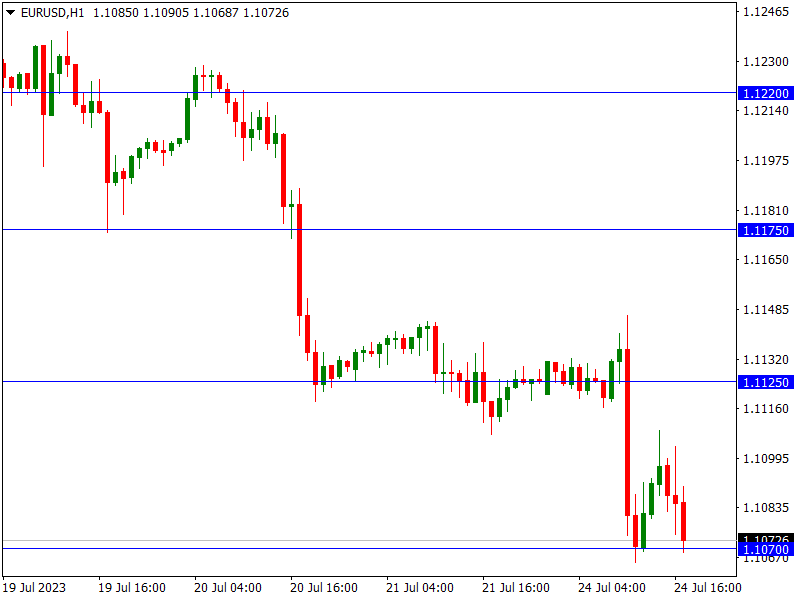

EURUSD

EURUSD – Drops To 1.1070 Support After PMI Data…

Manufacturing and Services PMI data announced in Europe today showed a contraction. Manufacturing PMI fell from 40.6 to 38.8 in Germany and from 43.4 to 42.7 in the Eurozone. On the US side, Manufacturing PMI rose from 46.3 to 49.0, while Services PMI fell to 52.4 from 54.4. With these developments, EURUSD parity fell to 1.1070 support. If a hold above this level is achieved, we can see recovery. In this case, 1.1125 and 1.1175 can be viewed as resistance. Breaking the 1.1070 level and below it can create support for 1.1025 and 1.0990.

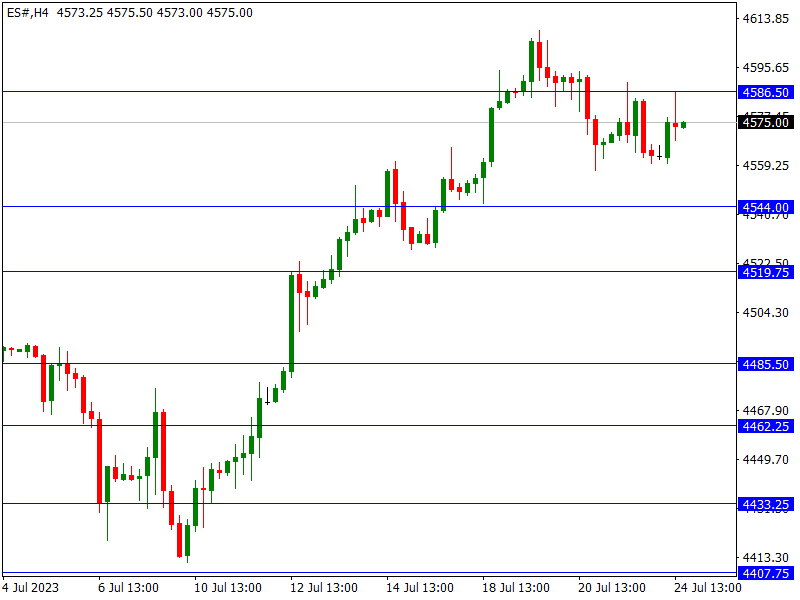

SP500

SP500 – 4586.50 Resistance Tested After PMI Data…

Manufacturing PMI for July, which we tracked in the USA, came in at 49.0, exceeding the expectations of 46.4. Services PMI, on the other hand, fell short of the expectation of 54.0 and came in at 52.4. After the data, 4586.50 resistance was tested in the SP500 Index, but it could not be passed. With the resistance encountered at this level, it also retreated. In pullbacks, 4544 and 4519.75 can be viewed as support. On the upside, 4586.50 and 4607 can be followed as resistance.

CDO TRADER

CDO TRADER, our cutting-edge trading platform, follows the technology from the forefront with new features added continuously. Moreover, CDO TRADER is now available for Android and iOS! So it allows you to trade on the go!

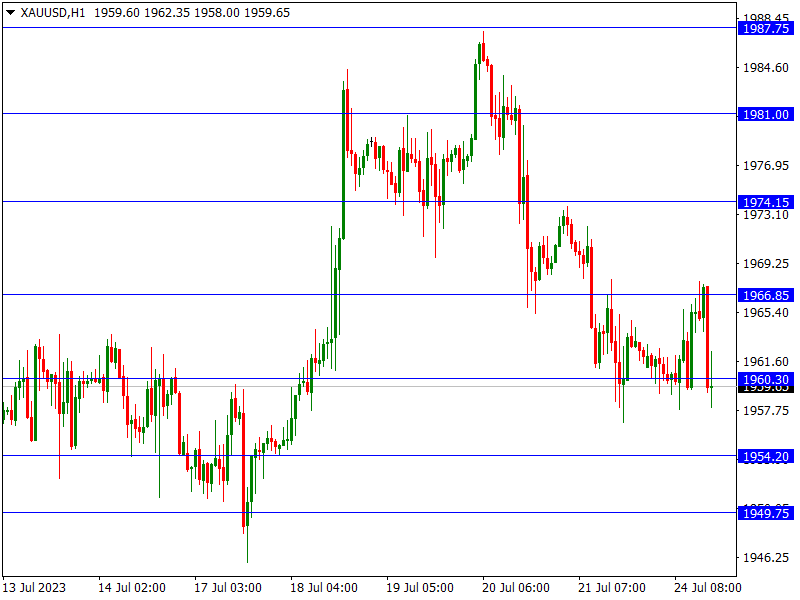

XAUUSD

Ounce Gold – Drops After PMI Data…

US Manufacturing PMI rose to 49.0 from 46.3, while Services PMI fell to 52.4 from 54.4. After the data, there were decreases in Ounce Gold with the effect of the resistance encountered at the level of 1966.85. In the continuation of the decline, 1954.20 and 1949.75 can be followed as support. In upward transactions, 1960.30 and 1966.85 may create resistance.

MetaTrader 4

MT4 has user friendly interface that is providing simplicity and efficiency. The traders can perform trading strategies for different products like Forex and CFD. MetaTrader 4 has over 50 built-in indicators, also it’s the tool that predicts trends and defines the appropriate entry and exit points.

Contact Us

Please, fill the form to get an assistance.