*As a result of the recovery of the dollar index and its rise above the 100 level, the risk appetite that has been going on for a while in the global markets decreased. Stock markets are taking a break from the general rally trend, albeit slightly. EURUSD – GBPUSD and Ounce Gold are down while USDJPY is going up.

*National CPI data from Japan was announced this morning. Annual basis data came from 3.2% to 3.3%. Again, this morning, according to unofficial sources, expectations began to emerge that the Bank of Japan would not raise the 10-year interest limit next week. However, as the meeting date approaches, there may be a lot of speculation on this subject.

*Next week, eyes will be on the three major central banks. First the FED, then the ECB and finally the BOJ will take the stage. Along with central bank data, PMI data on Monday, US growth on Thursday and Core PCE Price index data in the US on Friday will be critical.

*Former US President Donald Trump has set the hearing date as May 20, 2024. This date draws attention because it is after the Republican Party’s primary elections, which will end on March 12. Donald Trump is about the strongest candidate to be elected as a Republican candidate, thus creating the possibility that Trump could be tried as a possible Republican presidential candidate.

Open A Demo

CDO has wide range of tools, professional and friendly support for clients to achieve their financial markets trading goals. Open a live account now to enjoy this experience with virtual deposit.

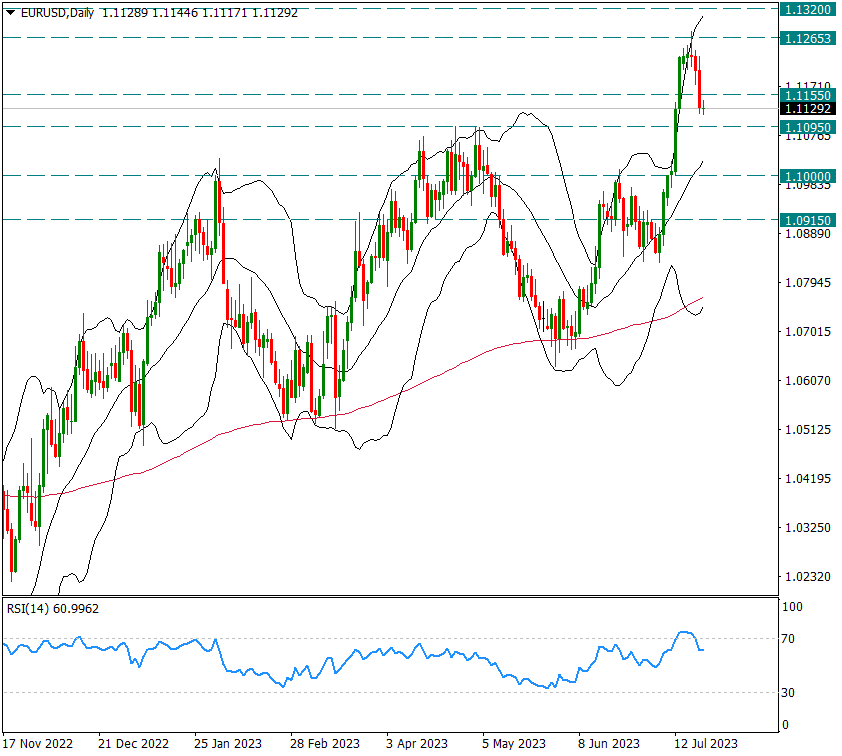

EURUSD

EURUSD – Correction Continues in Favor of Dollar, 1.1095 Initial Support…

The pair stopped it at 1.1265 after moving excessively in favor of the euro in the past weeks. With the corrections this week and especially yesterday, it approached the 1.1095 support. The 1.1095 level will be significant. Under this zone, movements in favor of the dollar may be a little more dominant.

We will focus on the FED and ECB meetings next week, and we predict that the volatility in the pair will increase next week due to these meetings.

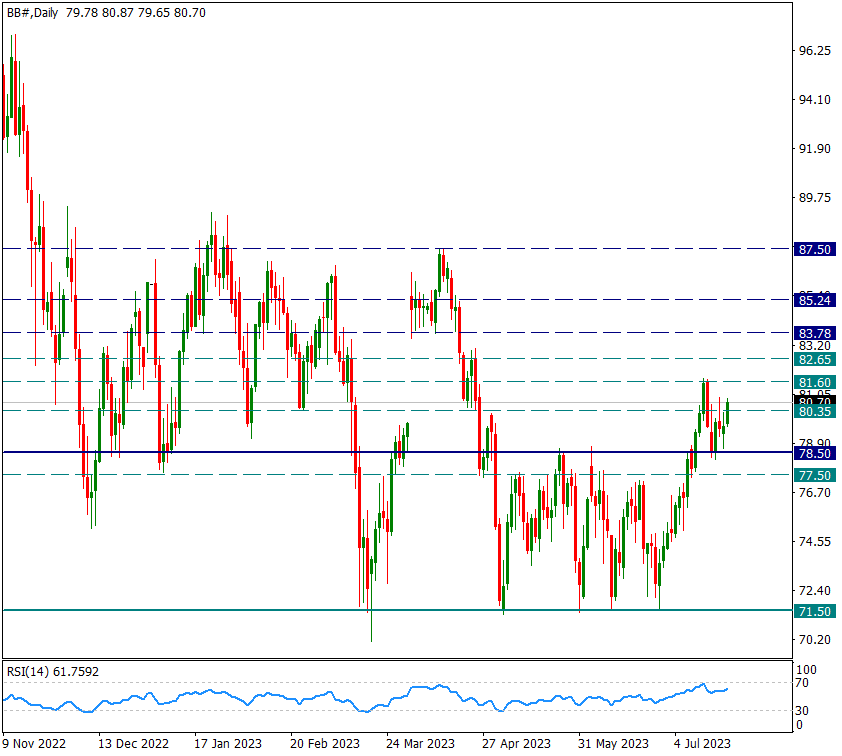

BRENT

Brent – Over $80 Again…

Brent oil prices rose nearly $1 on the last trading day of the week. It rose above $80 with additional support from 78.50 during the week. 81.60 is the main short term resistance and breaking this resistance could push Brent prices up strongly. It can keep the 87.50 level on the agenda.

CDO TRADER

CDO TRADER, our cutting-edge trading platform, follows the technology from the forefront with new features added continuously. Moreover, CDO TRADER is now available for Android and iOS! So it allows you to trade on the go!

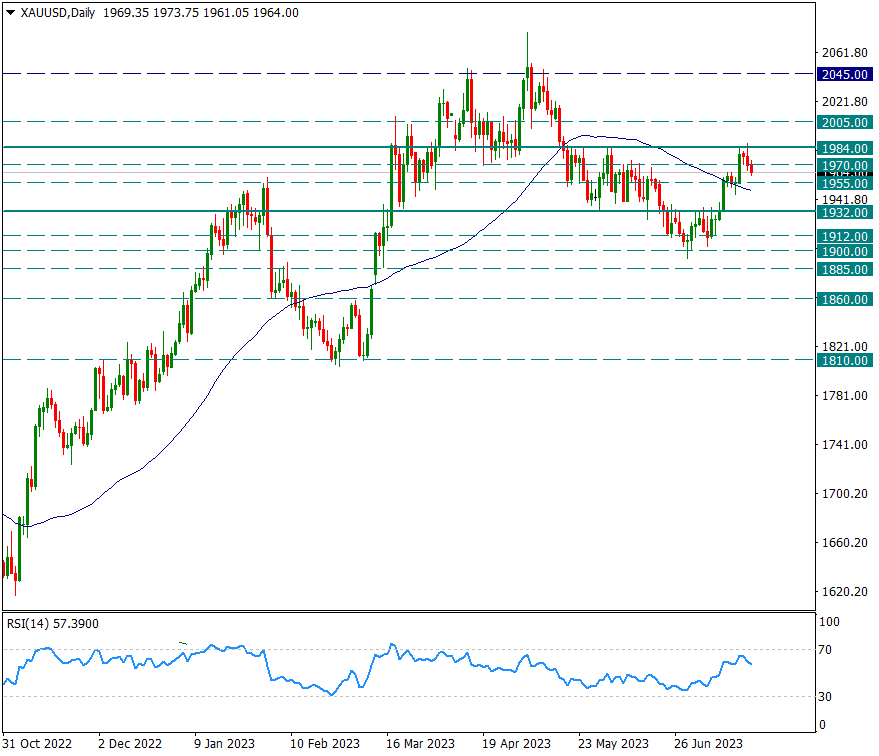

XAUUSD

Ounce Gold – 1955 Interim Support and We Follow a Possible TOBO Formation…

The yellow metal rose to the 1984 level this week, but could not break it despite testing it for 2-3 days. As of yesterday and today, we are seeing regressions from the 1984 level with the effect of the strengthening of the Dollar Index.

The next support below is the 1955 region, which coincides with the 50-day average.

On the daily chart, we are tracking the possibility of a possible upside-down head-to-shoulder formation. For this reason, 1955 is the intermediate support and 1932 is the main support. If the 1932 support is broken, the probability of TOBO formation may be impaired and a strong negative technical image may be encountered.

In order to trigger the TOBO formation, the 1984 resistance must be broken with a daily candle.

MetaTrader 4

MT4 has user friendly interface that is providing simplicity and efficiency. The traders can perform trading strategies for different products like Forex and CFD. MetaTrader 4 has over 50 built-in indicators, also it’s the tool that predicts trends and defines the appropriate entry and exit points.

Contact Us

Please, fill the form to get an assistance.