*The Employment Change for April in the UK, announced today, increased by 250 thousand, exceeding the expectation of 150 thousand. The number of unemployed decreased by 13,600 people. After these data, the Unemployment Rate decreased from 3.9% to 3.8%.

*The Zew Economic Index for June, which was announced today in Germany and the Euro Zone, came in at -8.5 and -10.0, respectively. Data for May came at the level of -10.7 and -9.4. In the evaluation made by the Zew Economist after the data, it was stated that the ZEW indicator showed a slight improvement, but remained in the negative territory and export-focused sectors are likely to underperform due to the weak global economy.

*In the USA, the Consumer Price Index (CPI), which was announced today and closely followed by the FED during the interest rate hike, increased by 0.1% on a monthly basis and increased by 4.0% on an annual basis. CPI was expected to increase by 0.2% and 4.1%, respectively. CPI also increased by 0.4% and 4.9% in April. Core CPI, on the other hand, increased by 0.4% monthly, while the annual rate of increase decreased from 5.5% to 5.3%. With the decrease in the rate of increase in inflation rates, the probability of not changing the interest rates in the meeting to be held tomorrow has increased to 97%.

Agenda of the day;

23:30 US API Crude Oil Stocks

Open A Demo

CDO has wide range of tools, professional and friendly support for clients to achieve their financial markets trading goals. Open a live account now to enjoy this experience with virtual deposit.

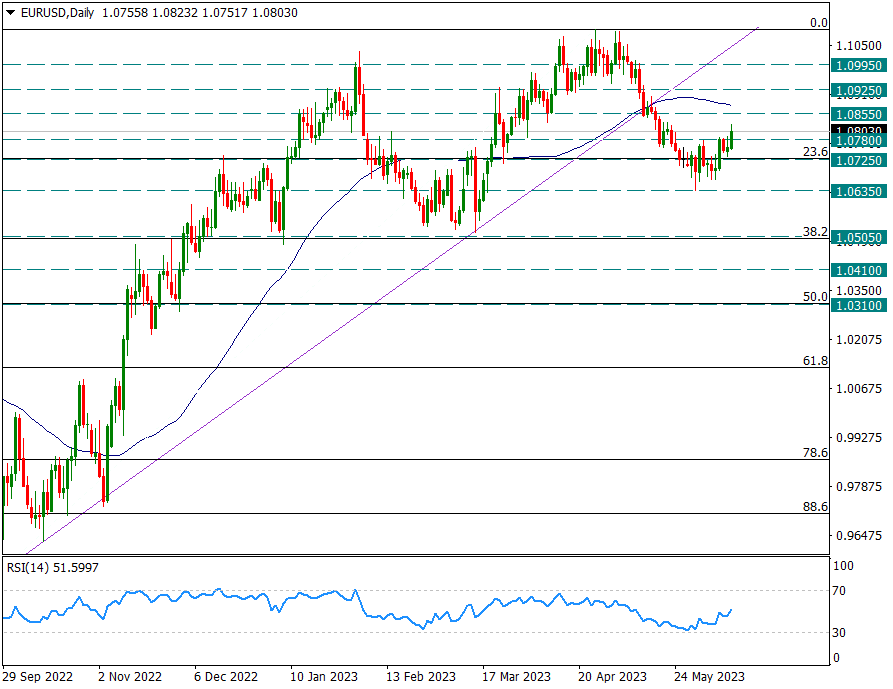

EURUSD

EURUSD – US Inflation Has Slightly Upward Effect…

The pair made an effort to stay above 1.0780 resistance during the day. Even though it regressed to 1.0780 before the inflation data from the USA from 15.30, the Dollar index lost its value after the US inflation, which continued its downward trend on an annual basis, and the parity again jumped above 1.08.

Before the Fed meeting tomorrow, cut interest rate hike expectations to almost zero. However, even if the FED passes tomorrow, this does not mean that the adventure of increasing interest rates is over, because according to the pricing of the CME FED Watch, 25 basis points of interest are already being priced in July.

For this reason, the upward attacks in the EURUSD parity do not go away and are quite gradual. Technically, a daily candle close above 1.0780 may weaken the downward pressures for the pair. However, on a weekly basis, we will watch the 50-day average as the main resistance line.

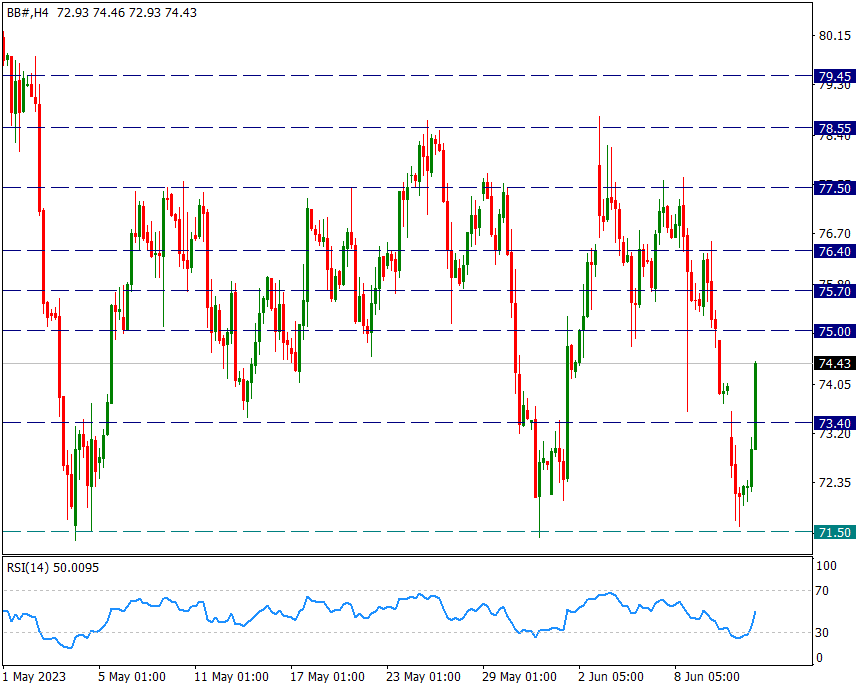

BRENT

BRENT – Nearly $3 Response From 71.50 Critical Support…

We mentioned that Brent prices have been moving in the horizontal band for a while between 78.55 and 71.50. After the rapid decline experienced this week, the prices, which came to the 71.50 support again, received a reaction from here and a rapid rise has been realized up to 74.40 since yesterday. This horizontal region has not been broken and it would not be wrong to say that pricing continues with the support and resistance in between.

CDO TRADER

CDO TRADER, our cutting-edge trading platform, follows the technology from the forefront with new features added continuously. Moreover, CDO TRADER is now available for Android and iOS! So it allows you to trade on the go!

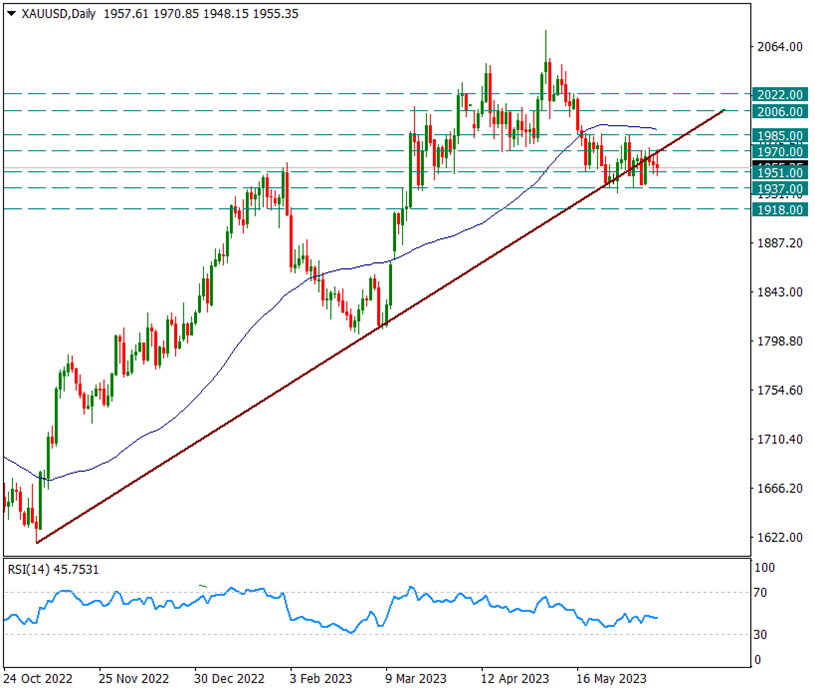

XAUUSD

Ounce Gold – Attacks Remain Weak, Suppressed Below 1970…

Although the yellow metal makes a slight attack after the declining US inflation data, it generally does not agree with the FED’s probability of passing tomorrow pricing. In fact, even if the FED passes tomorrow, this does not mean that the adventure of increasing interest rates is over, because a 25 basis point increase is currently expected at the July meeting.

While the yellow metal continues to stay under the 1970 intermediate resistance, it is slowly falling behind the uptrend from 1616.

Intraday movements have been in the 1970/1951 range for a few days. 1970 and 1951 are intermediate zones, while 1985 and 1937 are main intraday zones.

MetaTrader 4

MT4 has user friendly interface that is providing simplicity and efficiency. The traders can perform trading strategies for different products like Forex and CFD. MetaTrader 4 has over 50 built-in indicators, also it’s the tool that predicts trends and defines the appropriate entry and exit points.

Contact Us

Please, fill the form to get an assistance.